Welcome to the Hot Springs County, Wyoming Assessor's Department

The Goal of this office is to accurately, equitably and fairly value all property in Hot Springs County according to state law. Uniform values are the basis of a fair property tax system. It is your right and responsibility to make sure that the information used to value your property is accurate and up to date. Property records are available for your review at all times, and we welcome your comments and concerns.

Wyoming law requires that all property be valued at "Fair Market Value" with the exception of agricultural lands which are to be valued at their productive capability.

"Fair Market Value" is the price a knowledgeable buyer would be willing to pay for your property in its current condition.

Residential Property Tax Exemptions - Now Accepting Applications for Tax Year 2026

|

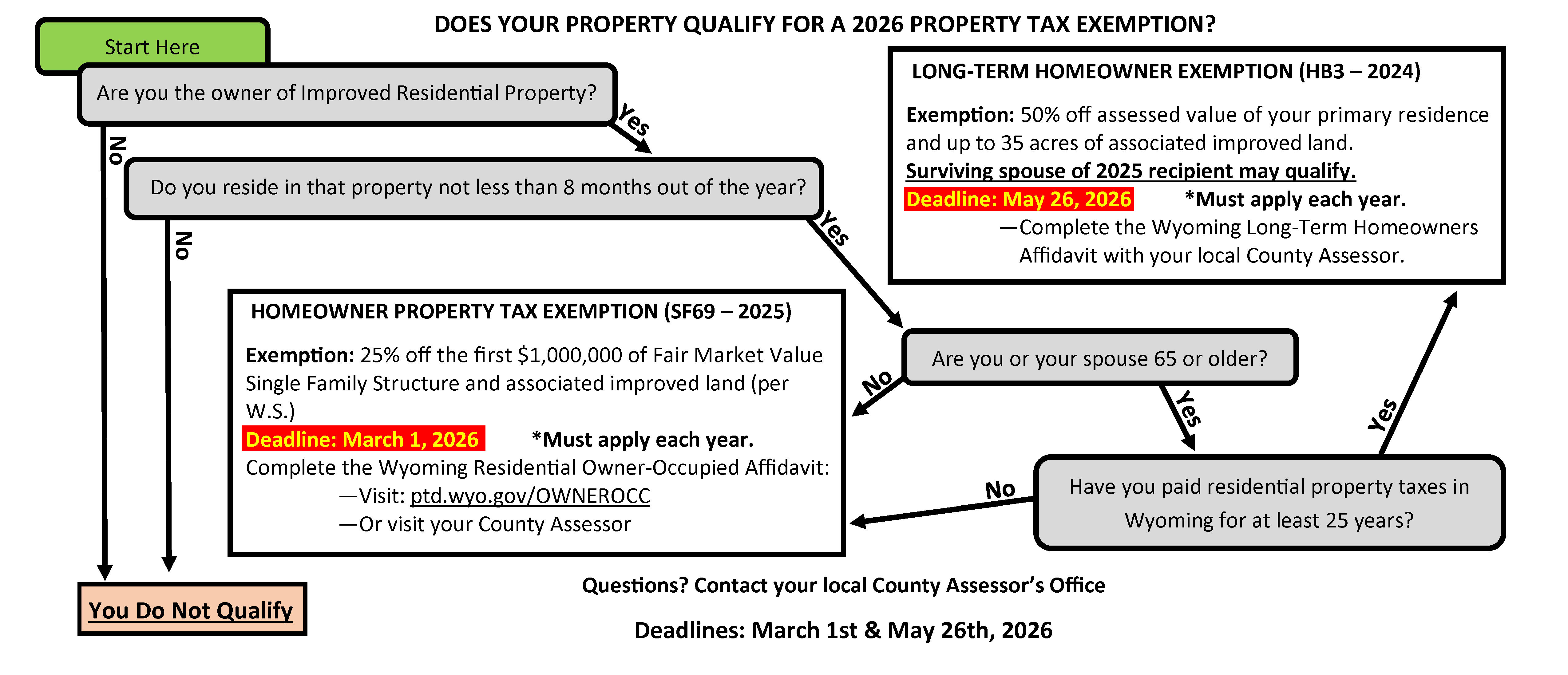

DO YOU QUALIFY FOR A 2026 PROPERTY TAX EXEMPTION? Here’s What You Need to Know |

|

HOMEOWNER PROPERTY TAX EXEMPTION (SF69 – 2025) Exemption: 25% off the first $1,000,000 of Fair Market Value Deadline: March 1, 2026 *Must apply each year. Requirements: • Single-family residential structure and associated improved land (per W.S.). • Owner must occupy the residence 8+ months/year. • Complete the Wyoming Residential Owner-Occupied Affidavit:

*Not available to persons who qualify for the Long-Term Homeowner Exemption. |

|

LONG-TERM HOMEOWNER EXEMPTION (HB3 – 2024) Exemption: 50% off assessed value of your primary residence and up to 35 acres of associated improved land. If you qualified in 2025 and there have been no ownership or residency changes: Complete the Wyoming Long-Term Homeowners Affidavit with your local County Assessor. - New applicants must: • Be 65+ years old (owner or spouse) • Have paid WY property tax for 25+ years • Occupy the residence 8+ months/year • Surviving spouse of 2025 recipient may qualify |

See the flowchart below to see if you meet the requirements for one of the residential property tax exemptions.

The Hot Springs County Assessor’s Office conducts an on-going and continuous program of reviewing all properties.

This review includes checking the size, type, condition and other characteristic information of all improvements on the property. These field checks are required by Wyoming Statutes and Department of Revenue Rules to ensure the information used in the valuation of properties is current and accurate. In addition, new construction and changes identified are reviewed and listed for assessments.

The Assessor’s office has a staff of four Appraisers conducting inspections.

All employees have photo identification issued by the county. They operate county vehicles. The first step in every property visit is to go to the door, identify themselves and explain the purpose of their visit. If no one is home, they leave a ‘Door-Hanger’ stating their names, our office phone number, and notes on any information that may be needed, and verify exterior property information.

Subdivision Plats (work in progress) – Scanned copies of Recorded Subdivision Plats These are NOT Ownership Plats. For Rural ownership, please see the Map Server Tab

Kirby

Assessor - Kirby

Downloads: 1384 | Size: 1.12 MB

Downloads: 1312 | Size: 321.16 KB

Downloads: 1228 | Size: 127.67 KB

Downloads: 1506 | Size: 2.25 MB

Downloads: 1349 | Size: 518.47 KB

Thermopolis

Assessor - Thermopolis

Downloads: 1291 | Size: 297.82 KB

Downloads: 1134 | Size: 742.17 KB

Downloads: 1064 | Size: 177.7 KB

Downloads: 1082 | Size: 209.93 KB

Downloads: 1154 | Size: 661.73 KB

Downloads: 1065 | Size: 292.01 KB

Downloads: 1027 | Size: 234.73 KB

Downloads: 1229 | Size: 957.31 KB

Downloads: 1096 | Size: 318.04 KB

Downloads: 1056 | Size: 463.2 KB

Downloads: 1000 | Size: 323.73 KB

Downloads: 1023 | Size: 282.21 KB

Downloads: 1073 | Size: 165.59 KB

Downloads: 1098 | Size: 705.17 KB

Downloads: 1064 | Size: 318.24 KB

Downloads: 1018 | Size: 471.19 KB

Downloads: 1177 | Size: 4.4 MB

Downloads: 1042 | Size: 548.99 KB

Downloads: 1103 | Size: 1.69 MB

Downloads: 1152 | Size: 3.35 MB

Downloads: 1080 | Size: 2.58 MB

Downloads: 1144 | Size: 4.03 MB

Downloads: 1082 | Size: 369.74 KB

Downloads: 1031 | Size: 819.72 KB

Downloads: 1141 | Size: 4.07 MB

Downloads: 955 | Size: 183.1 KB

Downloads: 989 | Size: 345.69 KB

Downloads: 1158 | Size: 585.12 KB

Downloads: 1007 | Size: 503.7 KB

Downloads: 1299 | Size: 815.05 KB

Downloads: 1069 | Size: 574.64 KB

Downloads: 882 | Size: 105.69 KB

Downloads: 968 | Size: 874.33 KB

East Thermopolis

Assessor - East Thermopolis

Downloads: 1071 | Size: 373.91 KB

Downloads: 1087 | Size: 837.08 KB

Downloads: 1012 | Size: 1.11 MB

Downloads: 1003 | Size: 1.35 MB

Downloads: 1006 | Size: 1.13 MB

Downloads: 996 | Size: 1.1 MB

Downloads: 997 | Size: 838.77 KB

Downloads: 951 | Size: 297.78 KB

Rural Subdivisions

Assessor - Rural Subdivisions

Downloads: 1008 | Size: 516.81 KB

Downloads: 957 | Size: 220.6 KB

Downloads: 953 | Size: 3.86 MB

Downloads: 979 | Size: 708.89 KB

Downloads: 926 | Size: 1.69 MB

Downloads: 931 | Size: 323.51 KB

Downloads: 981 | Size: 3.68 MB

Downloads: 971 | Size: 2.32 MB

Downloads: 877 | Size: 1.59 MB

Downloads: 958 | Size: 4.14 MB

Downloads: 901 | Size: 2.32 MB

Downloads: 926 | Size: 1.36 MB

Downloads: 956 | Size: 3.8 MB

Downloads: 991 | Size: 2.22 MB

Downloads: 924 | Size: 4.12 MB

Downloads: 825 | Size: 210.74 KB

Downloads: 920 | Size: 2.69 MB

Downloads: 882 | Size: 299.28 KB

Downloads: 957 | Size: 3.84 MB

Downloads: 894 | Size: 148.26 KB

Downloads: 897 | Size: 1.41 MB

Downloads: 918 | Size: 1.2 MB

Downloads: 971 | Size: 3.16 MB

Downloads: 840 | Size: 313.45 KB

Downloads: 908 | Size: 297.22 KB

Downloads: 910 | Size: 1.44 MB

Downloads: 864 | Size: 87.03 KB

Downloads: 881 | Size: 122.54 KB

Downloads: 888 | Size: 1.5 MB

Downloads: 946 | Size: 3.21 MB

Downloads: 859 | Size: 292.36 KB

Downloads: 879 | Size: 254.46 KB

Downloads: 919 | Size: 599.48 KB

Downloads: 983 | Size: 3.67 MB

Downloads: 818 | Size: 153.91 KB

Downloads: 953 | Size: 378.25 KB

Downloads: 822 | Size: 220.53 KB

Downloads: 916 | Size: 4.23 MB

Downloads: 940 | Size: 3.24 MB

Downloads: 832 | Size: 3.53 MB

Downloads: 994 | Size: 4.17 MB

Downloads: 951 | Size: 1.52 MB

Downloads: 870 | Size: 115.15 KB

Downloads: 1048 | Size: 1.61 MB

Downloads: 1257 | Size: 2.24 MB

Downloads: 930 | Size: 86.23 KB

Downloads: 975 | Size: 3.67 MB

Downloads: 1007 | Size: 2.36 MB

Downloads: 995 | Size: 2.04 MB

Downloads: 998 | Size: 1.31 MB

Downloads: 1068 | Size: 3.42 MB

Downloads: 982 | Size: 1.04 MB

Downloads: 905 | Size: 272.87 KB

Forms & Reference Materials: (work in progress)

Assessment & Appeal Information

Assessor - Assessment & Appeal Information

Downloads: 913 | Size: 14.85 KB

Downloads: 940 | Size: 22.94 KB

Downloads: 1297 | Size: 415.93 KB

Classification / Exemption Applications

Assessor - Classification Exemption Applications

Downloads: 846 | Size: 19.31 KB

Downloads: 904 | Size: 479.98 KB

Personal Property Forms

Assessor - Personal Property Forms

Downloads: 552 | Size: 8.18 KB

Downloads: 598 | Size: 87 KB

Downloads: 554 | Size: 125.83 KB

Downloads: 541 | Size: 120.42 KB

LINKS

Wyoming Bureau of Land Management (This link is for informational use of the GLO Plats for each Township in Hot Springs County, Wyoming)

HSC Road & Bridge (County Road Maps)